PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

GENERAL INFORMATION ABOUT THE MEETING

The Board of Directors of IPG Photonics Corporation is soliciting proxies from our stockholders in connection with our annual meeting of stockholders to be held on Tuesday, June 5, 2018 and any and all adjournments thereof. No business can be conducted at the annual meeting unless a majority of all outstanding shares entitled to vote are either present in person or represented by proxy at the meeting. As far as we know, the only matters to be brought before the annual meeting are those referred to in this proxy statement. If any additional matters are presented at the annual meeting, the persons named as proxies may vote your shares in their discretion.

This proxy statement and our 2017 annual report are first being made available to stockholders of record on or about April 18, 2018 atinvestor.ipgphotonics.com.Information on the website does not constitute part of this proxy statement.

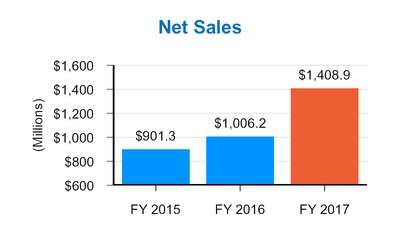

Unless otherwise noted, the information in this proxy statement covers our 2017 fiscal year (or "fiscal 2017"), which ran from January 1, 2017 through December 31, 2017, and in some cases our 2016 fiscal year (or "fiscal 2016"), which ran from January 1, 2016 through December 31, 2016.

Questions and Answers about the Meeting and Voting

When and Where Is the Annual Meeting?

| | | | | | | | | | | |

DIRECTOR

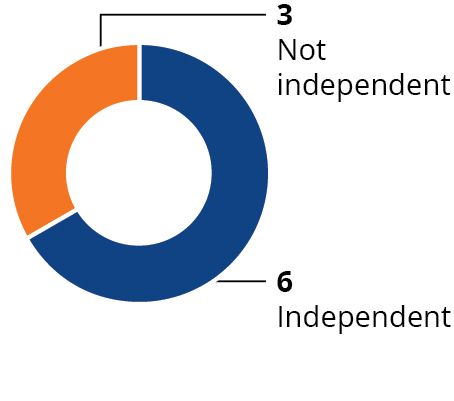

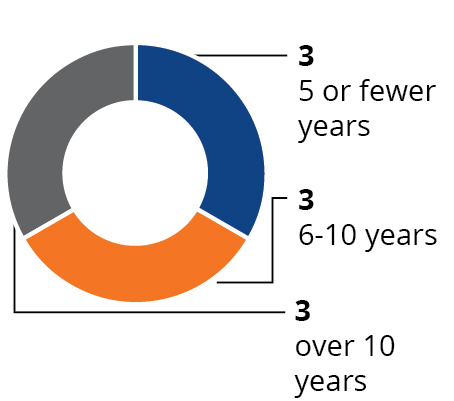

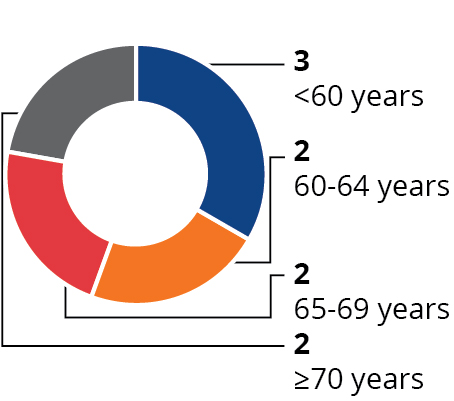

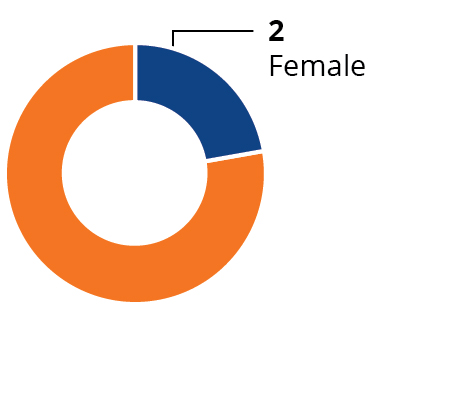

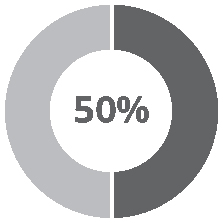

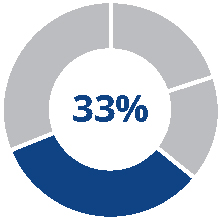

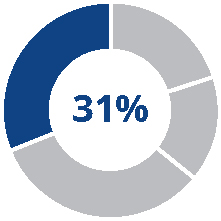

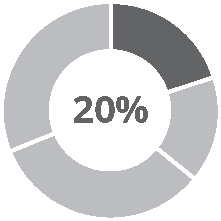

INDEPENDENCE | BALANCED TENURE | AGE | DIVERSITY |

| | |

When: | | Tuesday, June 5, 2018, at 10:00 a.m. Eastern Time |

Where: | | IPG Photonics Corporation | | |

6/9 50 Old Webster Roaddirectors

are independent**

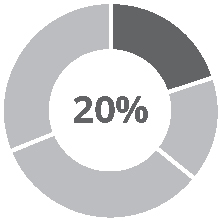

| 10 years Oxford, Massachusetts 01540Average Tenure

| 63 years Average Age

| 22% Female |

| | | |

What Matters Am I Being Asked to Vote On at* Following the Annual Meeting and What Vote is Required to Approve Each Matter?

You are being asked to vote on two proposals.

Proposal 1 requests the election of directors. Each director will be elected by the vote of the plurality of the votes cast when a quorum is present. A "plurality of the votes cast" means that the nine persons receiving the greatest number of votes cast "for" will be elected. "Votes cast" excludes "withhold votes" and any broker non-votes (as defined below). Accordingly, withhold votes and broker non-votes will have no effect on Proposal 1. If you hold your shares in "street name," it is critically important that you submit your voting instructions to your bank or broker if you want your shares to count for Proposal 1.

Proposal 2 requests the ratification of the appointment of our independent registered public accounting firm for 2018. The affirmative vote of a majority of the shares which are present at the meeting in person or by proxy, and entitled to vote thereon, is required for approval of Proposal 2. Abstentions have the same effect as voting against Proposal 2.

Who Is Entitled to Vote at the Meeting?

You are entitled to vote at the meeting if you owned IPG Photonics shares (directly or in "street name," as defined below) as of the close of business on April 6, 2018, the record date for the meeting. On that date, 53,732,790 shares of our common stock were outstanding and entitled to vote and no shares of our preferred stock were outstanding. Each share of our common stock is entitled to one vote with respect to each matter on which it is entitled to vote. There is no cumulative voting with respect to any proposal.

What Do I Need to Do If I Plan to Attend the Meeting in Person?

If you plan to attend the annual meeting in person, you must provide proof of your ownership of our common stock and a form of personal identification, such as a driver's license, for admission to the meeting. If you are a stockholder of record, the top half of your proxy card is your admission ticket and will serve as proof of ownership. If you hold your shares in street name, a recent brokerage statement or a letter from your bank or broker are examples of proof of ownership. If you hold your shares in street name and you also wish to be able to vote at the meeting, you must obtain a proxy, executed in your favor, from your bank or broker.

What Is the Difference Between Holding Shares Directly as a Stockholder of Record and Holding Shares in "Street Name" at a Bank or Broker?

Most of our stockholders hold their shares directly through a broker, bank or other nominee rather than directly in their own name. As summarized below, there are differences between shares held of record and those held in "street name."

Stockholder of Record: If your shares are registered directly in your name with our transfer agent, Computershare, N.A., you are considered the stockholder of record with respect to those shares, and the proxy statement and annual report were sent directly to you. As the stockholder of record, you have the right to vote your shares as described herein.

"Street Name" Stockholder: If your shares are held by a bank, broker or other nominee on your behalf, you are considered the beneficial owner of shares held in "street name," and the proxy statement and annual report were forwarded to you by your bank,broker or other nominee who is considered the stockholder of record with respect to those shares. Your bank, broker or other nominee sent to you, as the beneficial owner, a document describing the procedure for voting your shares. You should follow the instructions provided by your bank, broker or other nominee to vote your shares. You are also invited to attend the annual meeting. However, if you wish to be able to vote at the meeting, you must obtain a proxy card, executed in your favor, from your bank, broker or other nominee.

What Does it Mean to Give a Proxy?

Your properly completed proxy/voting instruction card will appoint Valentin P. Gapontsev and Angelo P. Lopresti as proxy holders or your representatives to vote your shares in the manner directed therein by you. Dr. Gapontsev is our Chairman of the Board and Chief Executive Officer. Mr. Lopresti is our Senior Vice President, General Counsel and Secretary. Your proxy permits you to direct the proxy holders to vote "For" or "Withhold" for the nominees for director (Proposal 1), and "For," "Against," or "Abstain" the vote to ratify the appointment of our independent registered accounting firm (Proposal 2).

All of your shares entitled to vote and represented by a properly completed proxy or voting instruction received prior to the meeting and not revoked will be voted at the meeting in accordance with your instruction.

What Happens If I Sign, Date and Return My Proxy But Do Not Specify How I Want My Shares Voted on One of the Proposals?

Stockholder of Record: Your proxy will be counted as a vote "For" all of the nominees for director (Proposal 1), and "For" the vote to ratify the appointment of our independent registered accounting firm (Proposal 2).

"Street Name" Stockholder: Your bank, broker or nominee may vote your shares only on those proposals on which it has discretion to vote. Under New York Stock Exchange rules, your bank, broker or nominee does not have discretion to vote your shares on non-routine matters such as the election of directors (Proposal 1). This is called a "broker non-vote." However, your bank, broker or nominee does have discretion to vote your shares on routine matters such as the vote to ratify the appointment of our independent registered public accounting firm (Proposal 2). Accordingly, if you do not give your bank, broker or nominee specific instructions with respect to Proposal 2, your shares will be voted in such entity's discretion (but only with respect to Proposal 2). We urge you to promptly

provide your bank, broker or nominee with appropriate voting instructions so that all of your shares may be voted at the meeting.

Can I Change My Vote Before the Meeting?

You can change your vote at any time before your proxy is exercised by delivering a properly executed, later-dated proxy (including an internet or telephone vote), by revoking your proxy by written notice to the Secretary of IPG Photonics, or by voting in person at the meeting. If you choose to revoke your proxy by attending the annual meeting, you must vote your shares for revocation to be effective. The method by which you vote by a proxy will in no way limit your right to vote at the meeting if you decide to attend in person.

If your shares are held in street name, please refer to the information forwarded by your bank, broker or nominee for procedures on changing your voting instructions.

Is the Proxy Statement Available on the Internet?

Yes. We are delivering our proxy statement and 2017 annual report pursuant to the Securities and Exchange Commission rules that allow companies to furnish proxy materials to their stockholders over the internet. On or about April 18, 2018, we will mail to our stockholders a notice (the “Notice”) containing instruction on how to access this proxy statement and our annual report and to vote via the internet or by telephone. Stockholders can view these documents on the internet by accessing the website at investor.ipgphotonics.com.

What does it mean if I receive more than one Notice of Internet Availability of Proxy Materials?

You may receive more than one Notice, more than one e-mail or multiple proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you may receive a separate Notice, a separate e-mail or a separate voting instruction card for each brokerage account in which you hold shares. If you are a stockholder of record and your shares are registered in more than one name, you may receive more than one Notice, more than one e-mail or more than one proxy card. To vote all of your shares by proxy, you must complete, sign, date and return each proxy card and voting instruction card that you receive and vote over the internet the shares represented by each Notice that you receive (unless you have requested and received a proxy card or voting instruction card for the shares represented by one or more of those Notices).

Who Is Soliciting my Proxy and Who is Paying for the Cost of this Proxy Solicitation?

The Board of Directors of IPG Photonics is soliciting your proxy to vote at the 2018 annual meeting of stockholders. IPG Photonics will bear the expense of preparing, posting to the internet, printing and mailing this proxy material, as well as the cost of any required solicitation. Our directors, officers or employees may solicit proxies on our behalf. We have not engaged a proxy solicitation firm to assist us in the solicitation of proxies, but we may if we deem it appropriate. In addition, we will reimburse banks, brokers and other custodians, nominees and fiduciaries for reasonable expenses incurred in forwarding proxy materials to beneficial owners of our stock and obtaining their proxies.

Who Counts the Votes?

We have engaged Computershare, N.A. as our independent agent to receive and tabulate stockholder votes. Computershare, N.A. will separately tabulate "For," "Against" and "Withhold" votes, abstentions and broker non-votes. Computershare, N.A. will also act as independent election inspector to certify the results, determine the existence of a quorum and the validity of proxies and ballots, and perform any other acts required under the General Corporation Law of Delaware.

How Can I Vote?

Most stockholders have a choice of voting in one of four ways:

via the internet,

using a toll-free telephone number,

completing a proxy/voting instruction card and mailing it in the postage-paid envelope provided or

in person at the meeting.

The telephone and internet voting facilities for stockholders of record will close at 1:00 a.m. Central Time on June 5, 2018. The internet and telephone voting procedures are designed to authenticate stockholders by use of a control number and to allow you to confirm that your instructions have been properly recorded.

If you hold your shares in "street name," your bank, broker or other nominee will send you a separate package describing the procedures and options for voting your shares. Please read this information carefully. If you hold your shares in "street name," and wish to vote in person at the annual meeting, you must obtain a "legal proxy" from the organization that holds your shares. A legal proxy is a written document that will authorize you to vote your shares held in "street name" at the annual meeting. Please contact the organization that holds your shares for instructions regarding obtaining a legal proxy. You must bring a copy of the legal proxy to the annual meeting and ask for a ballot when you arrive.

What Is the Quorum Required to Transact Business?

At the close of business on April 6, 2018, the record date, there were 53,732,790shares of our common stock outstanding. Our by-laws require that a majority of our common stock be represented, in person or by proxy, at the meeting in order to constitute the quorum we need to transact business at the meeting. We will count withhold votes, abstentions and broker non-votes in determining whether a quorum exists.

CORPORATE GOVERNANCE

Significant Corporate Governance Practices and Policies

At IPG Photonics, we believe that strong and effective corporate governance procedures and practices are an extremely important part of our corporate culture. We have summarized several of our corporate governance practices below.

Independent Director Majority and Presiding Independent Director. Seven of the ten directors currently on our Board of Directors (the "Board") are non-employees of the Company who meet the independence criteria under the applicable rules of the Securities and Exchange Commission ("SEC") and NASDAQ guidelines. Only independent directors sit on our three standing Board Committees. Several years ago, the Board established the role of a presiding independent director who is elected annually by the independent directors.

Executive Sessions. Our Board meets regularly in executive sessions without the presence of management, including our Chairman and Chief Executive Officer. These sessions are led by our Presiding Independent Director.

Annual Election of Entire Board. Stockholders elect each director annually. We do not have a classified board.

Related Person Transactions. Our Nominating and Corporate Governance Committee is responsible for approving or ratifying transactions involving our Company and related persons and determining if the transaction is in, or not inconsistent with, the best interests of our Company and our stockholders.

Stock Ownership Guidelines. Our directors and executive officers are required to own a minimum amount of IPG Photonics shares. We believe that stock ownership requirements align the interests of the directors and officers with our stockholders. Our directors and executive officers fully complied with our guidelines in 2017.

Prohibition on Hedging; Limits on Pledging. Our insider trading policy expressly prohibits directors and employees from engaging in short sales of our common stock or buying or selling puts, calls or derivative securities in connection with IPG Photonics shares. The policy also limits the pledging of IPG Photonics shares.

Annual Self-Assessments. Our Board engages in annual self-evaluations and our committees perform bi-annual self-assessments to determine if they are functioning effectively.

Oversight of Risk Management. As part of its oversight, the entire Board reviews Company strategy and performance and the principal risks involved. The Board allocates risk oversight responsibility among the full Board, the independent directors acting as a group and the three standing committees.

Additional information is provided below regarding these and certain other key corporate governance policies, which we believe enable us to manage our business in accordance with high standards of business practices and in the best interest of our stockholders. Several of our policies may be found at investor.ipgphotonics.com/corporate-governance/governance-documents. Note that information on our website does not constitute part of this proxy statement.

Corporate Governance Guidelines

Our Board has adopted Corporate Governance Guidelines that outline, among other matters, the roles and functions of the Board, the responsibilities of various Board committees and the mission of the Board. Each of the Board committees has a written charter that sets forth the purposes, goals and responsibilities of the committees as well as qualification for committee membership, procedures for committee membership, appointment and removal, committee structure and operations and committee reporting to the entire Board.

The Corporate Governance Guidelines provide, among other things, that:

a majority of our Board must be independent,

the Presiding Independent Director presides over executive sessions of independent directors,

the Board appoints all members and chairpersons of the Board committees,

the** Audit, Compensation and Nominating and Corporate Governance Committees consist solelyare composed entirely of independent directors

Skills and Experience*

| | | | | | | | | | | | | | | | | | | | |

| Lasers and

Technology | | | | Risk

Management | |

| Financial

Literacy | | | | Executive

Leadership | |

| Global

Business | | | | Other Public

Company Boards | |

| Manufacturing

and Operating | | | | Non-Corporate Experience | |

| Business

Development

and M&A | | | | | |

* Following the independent directors meet periodically in executive sessions withoutAnnual Meeting

6 NOTICE OF 2021 ANNUAL MEETING AND PROXY STATEMENT

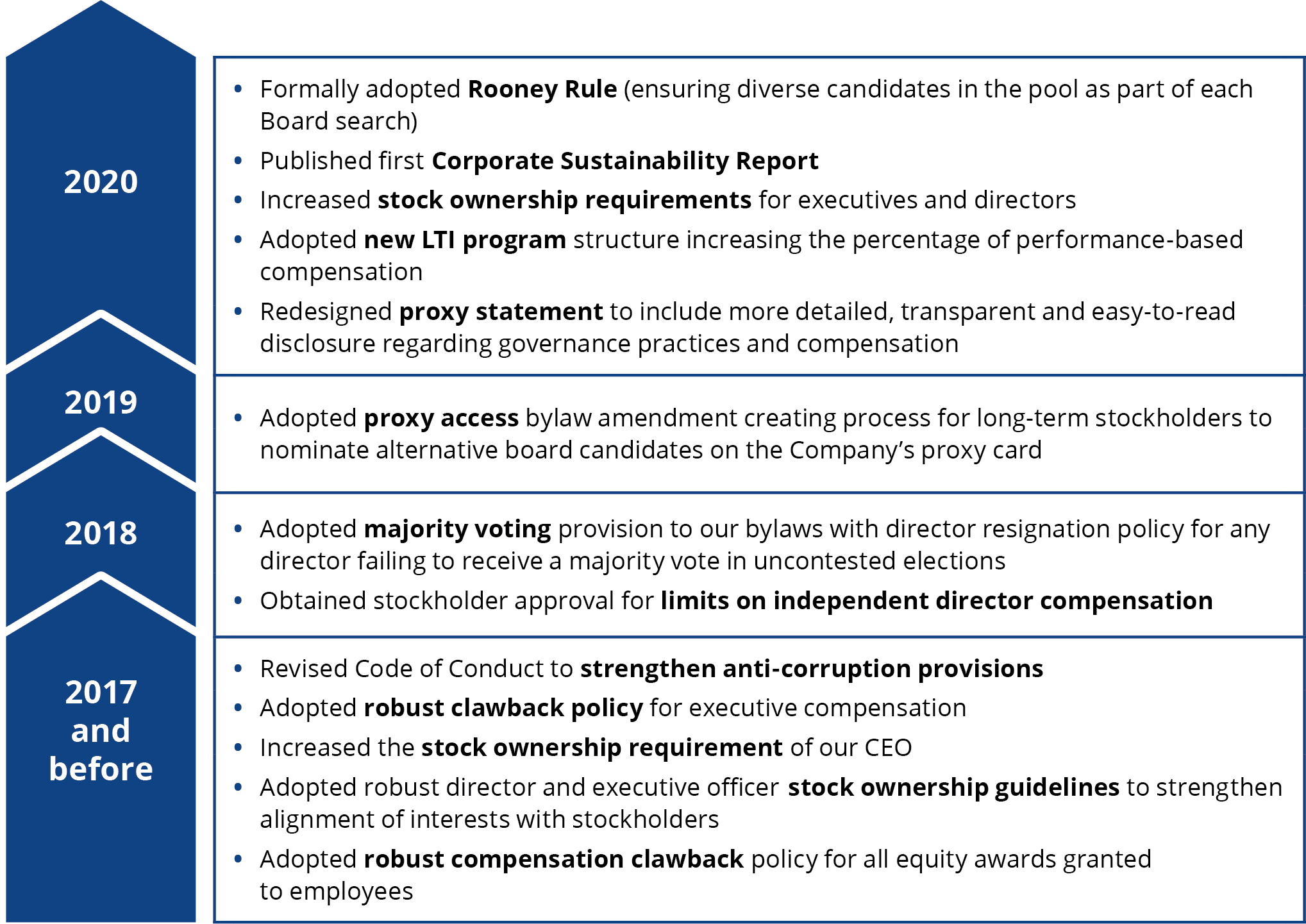

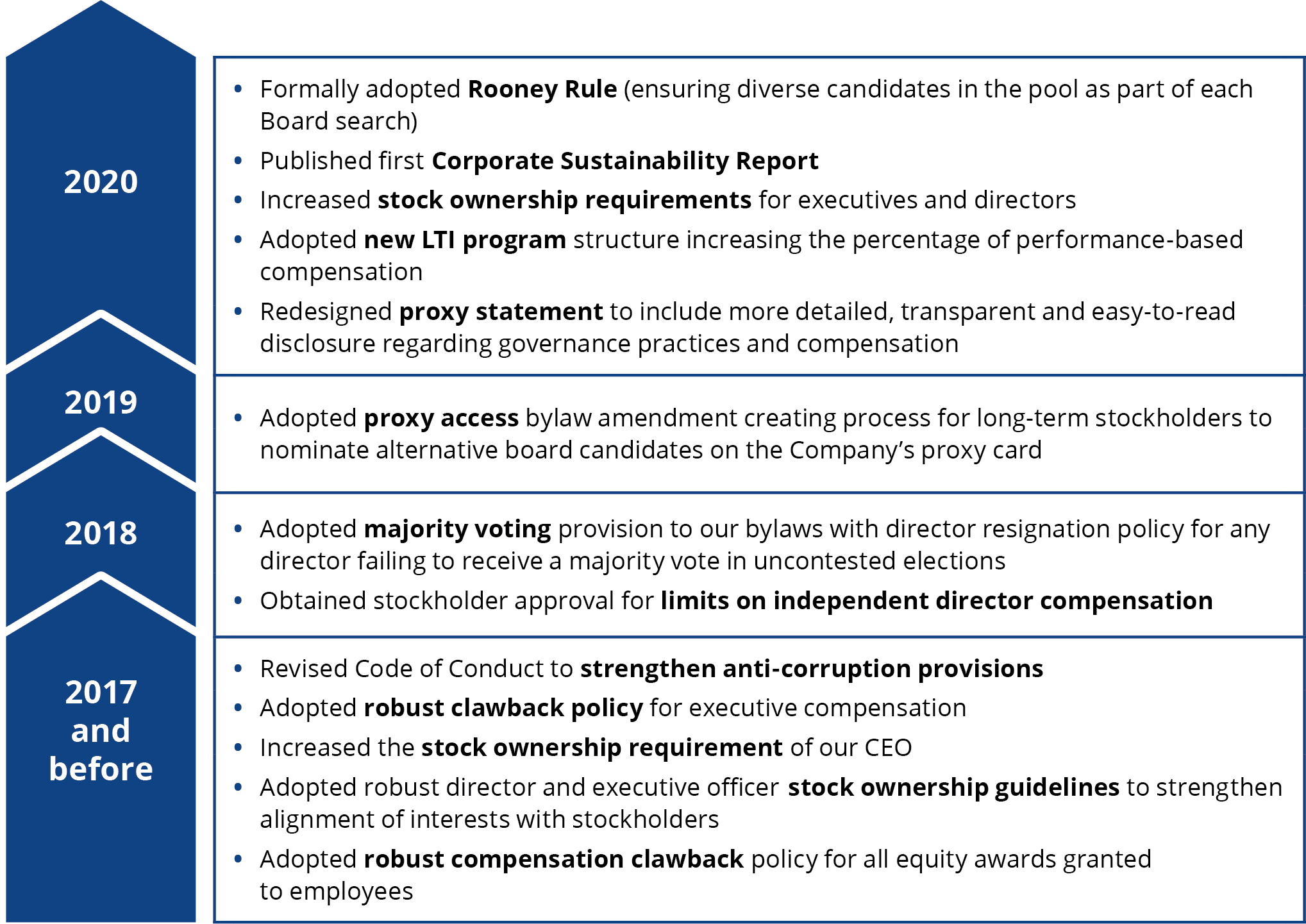

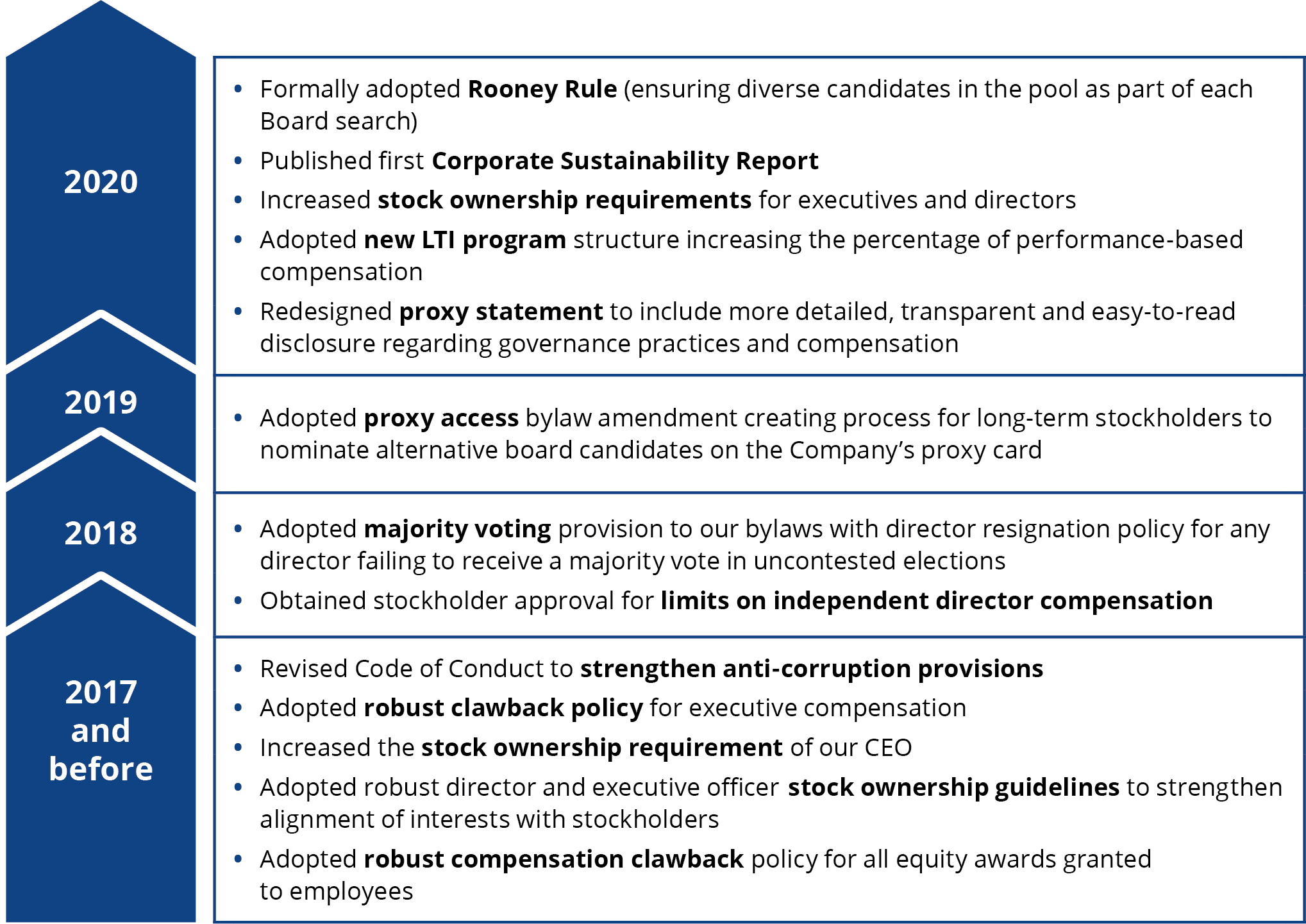

Corporate Governance Highlights

| | | | | | | | | | | |

| | | |

üNew policy to require external director candidate pool to include female and/or racially/ethnically diverse candidates adopted in October 2020 üStockholder proxy access right adopted in March 2019 ü Director majority voting policy adopted in October 2018 ü Ongoing Board refreshment: 2 female directors added in 2021; 3 new directors in 3 years ü Supermajority of independent directors and 100% independent Board committees | ü 67% of Board members were born outside of the U.S.A., bringing international perspectives ü 22% of Board members are women ü Lead independent director ü Single class of voting stock and no supermajority voting provisions ü Annual election of all directors ü Stockholder right to act by written consent E | ü 79% of director compensation at risk based upon stock performance ü Annual Board performance evaluations ü Robust director and executive officer stock ownership guidelines ü Anti-hedging policy applicable to all employees and directors ü Bylaw adopted in 2020 to ensure Board decision-making and continuity in event of director unavailability due to emergency, such as pandemic | |

| | | |

Stockholder Engagement

We value the presence of the non-independent directors or membersviews of our management,

directors may not servestockholders and we believe that building positive relationships with our stockholders is critical to our long-term success. Our investor communications and outreach include periodic site visits, investor conferences and quarterly conference calls. Our quarterly conference calls and presentations at investor conferences are open to the public and are available live and as archived webcasts on the boards of more than three other public companies or on more than two other audit committees of public companies,

evaluation ofour website. To help management and the Board is conducted annuallyunderstand and consider the issues that matter most to our stockholders, we periodically engage with our stockholders on a range of topics including performance, executive compensation, governance and sustainability matters; our Board has been responsive to feedback it has received.

In response to a stockholder proposal at the 2020 annual meeting, which did not win a majority of votes cast, the Board considered management diversity at IPG and key officers should havesupported advancing our human capital management strategy to ensure more opportunities for diverse candidates, including new programs to recruit diverse candidates, developing internal candidates for executive openings and seeking out diverse candidates in outside searches. Following investor requests for greater diversity in director recruitment, the Board added two female members to the Board in January 2021 and formally adopted a meaningful financial stakewritten policy to require external director candidate pools to include female and/or racially/ethnically diverse candidates. We engaged with a number of stockholders regarding other environmental, social, and governance (ESG) topics last year and we are committed to enhancing disclosure in this area. In December 2020, we published our first Corporate Sustainability Report, which highlighted the Company.efforts we are taking to address public policy issues and ESG matters, including health, safety and environmental and sustainability policies.

The Board reviews changing legal and regulatory requirements, evolving best practices and other developments. The Board modifies the Corporate Governance Guidelines and its other corporate governance policies and practices from time to time, as appropriate.Features of our Executive Compensation Program

| | | | | | | | |

| | |

| PRACTICES WE EMPLOY | | PRACTICES WE AVOID |

| | |

ü Align our officer pay with performance ü Balance annual and long-term incentives ü Use long-term incentives to link executive pay to company performance ü Cap incentive award payouts ü Maximize stockholder value while mitigating risk ü Independent compensation consultant ü Robust stock ownership requirements ü Clawbacks on executive compensation | | û No guaranteed annual bonuses û No retirement benefits û No tax gross-ups û No significant perquisites û Prohibit hedging of Company stock û No severance for “cause” terminations û No single-trigger change in control provisions û No stock option repricing without stockholder approval û Pledging of Company stock is limited

|

7

7

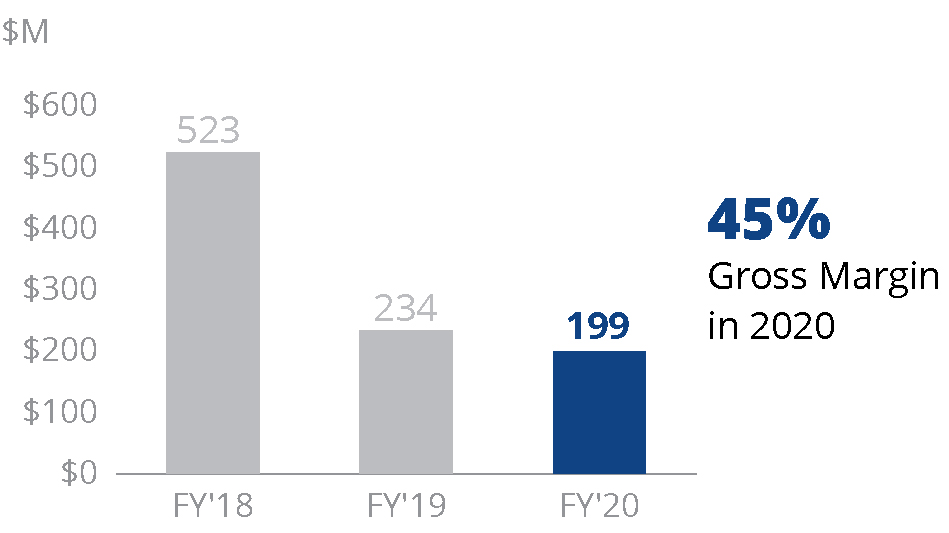

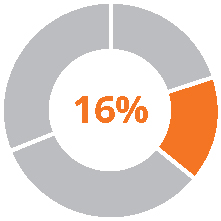

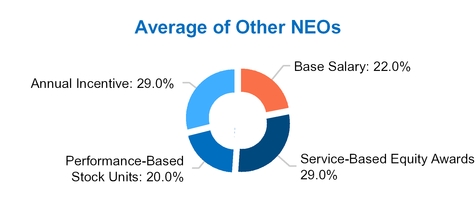

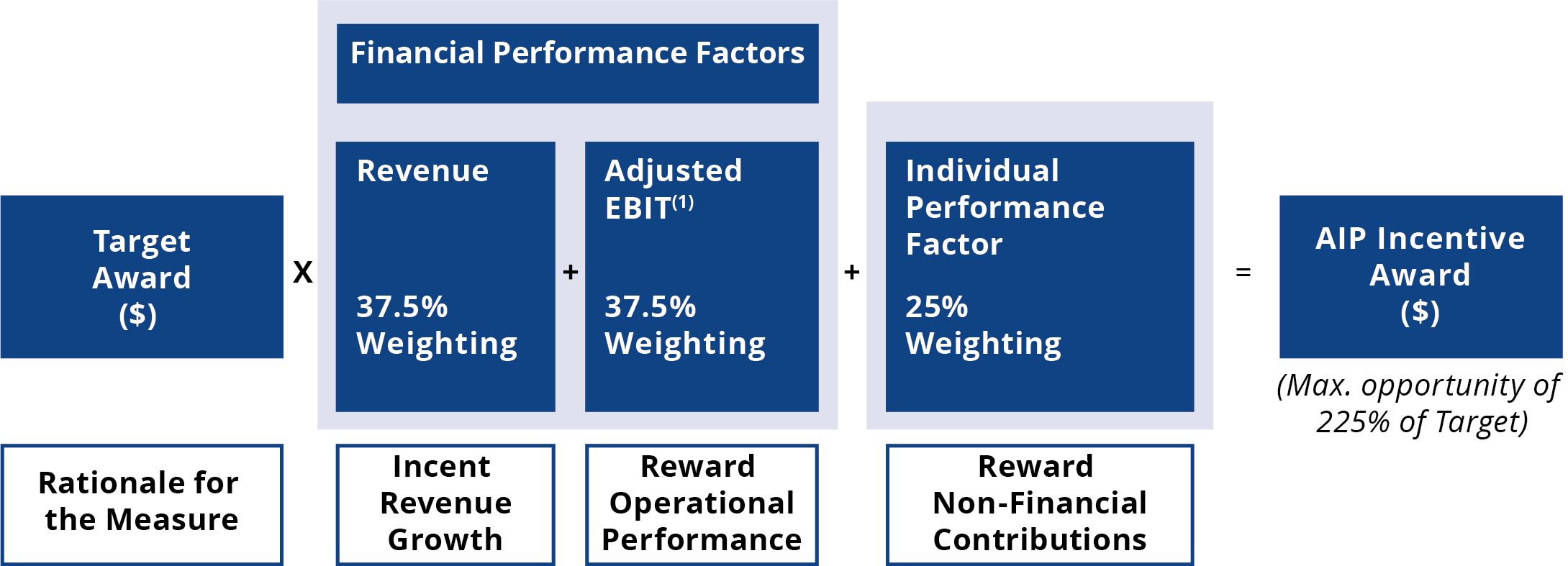

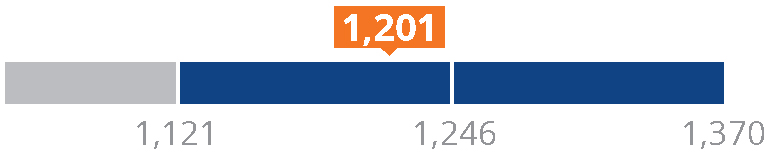

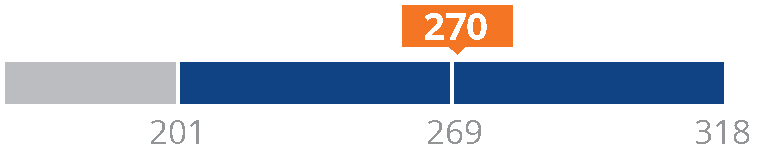

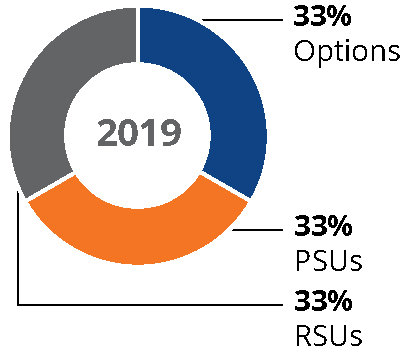

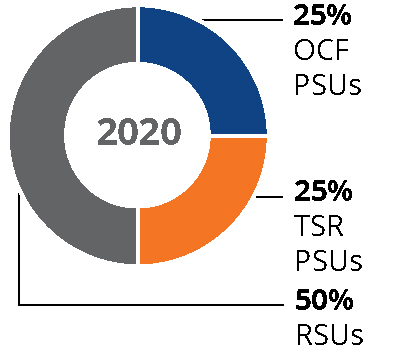

2020 Executive Compensation Highlights

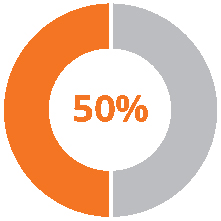

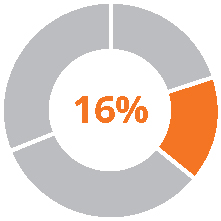

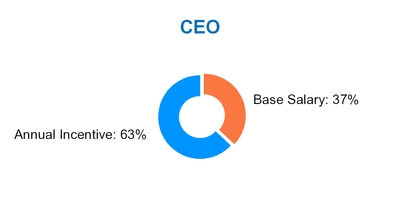

Executive Sessions.As further discussed in Compensation Discussion and Analysis Our independent directors meet privately, without employee directors or management present, at least four times duringstarting on page 37, the year. These private sessionsguiding principles of our executive compensation philosophy are generally held in conjunctionpay-for-performance, accountability for annual and long-term performance, alignment with the regular quarterly Board meetings. Other private meetings of the independent directors are held as often as deemed necessary by them. stockholders’ interests, and providing competitive pay to attract and retain executives. The 2020 compensation program for our named executive officers ("NEOs") has three primary components: annual base salary, annual cash incentives and long-term equity incentives. | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fixed | | | At-risk | | | | |

| Base Salary | | Annual Cash Incentive | | Long-Term Equity Incentives |

| Target Mix | CEO* | OTHER NEOs (Average) | | CEO | OTHER NEOs (Average) | | OTHER NEOs

(Average) |

| | | | | | | | |

| * CEO receives no equity awards | | | | | | PSUs (Performance Based) | RSUs (Service Based) |

| | | | | | | | |

| | | | | | | | |

| Performance | • Executive base salaries were not increased for 2020 in light of the challenging macro-economic environment continuing to face the Company | | • Annual cash incentive amounts for our NEOs were based on full year financial targets set in early February 2020, in spite of the challenges brought by the COVID-19 pandemic • Individual performance awards were earned for managing effectively through unprecedented business environment | | • In 2020, we increased the percentage of our long-term incentives that are performance-based and added an operating metric to our PSUs • Our CEO, as the founder and a significant stockholder, has not received an equity award since the Company’s 2006 IPO, resulting in lower compensation expenses and equity burn rate |

| | | | | |

| Objectives | • Provide a competitive fixed component to attract and retain talented and experienced executives | | • Variable cash compensation opportunity is based upon annual net sales and profitability against threshold, target and maximum performance goals • Additional compensation opportunities are based upon individual performance | | • Align interests of our executives and stockholders by motivating executive officers to increase long-term stockholder value • PSU awards provide incentives and are earned based on IPG’s total stockholder return relative to a comparable stock index and, new for 2020, an operating metric based upon operating cash flow • Service-based RSUs awards vest over four years providing long-term retention and additional compensation opportunity for stock price increases |

| | | | | | | | |

8 NOTICE OF 2021 ANNUAL MEETING AND PROXY STATEMENT

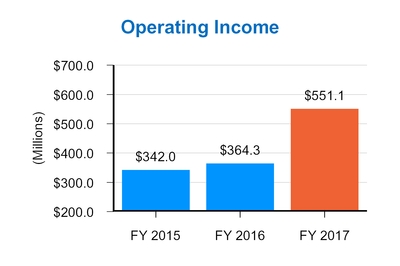

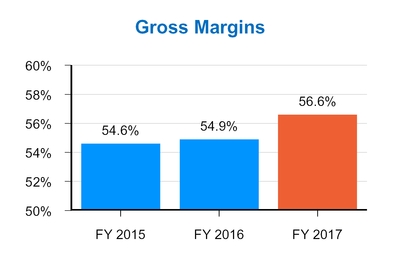

Compensation Alignment with Stockholder Interests and Performance

| | | | | | | | |

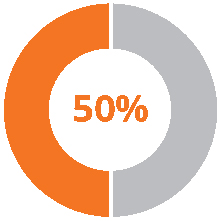

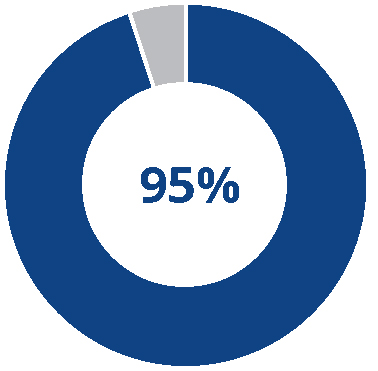

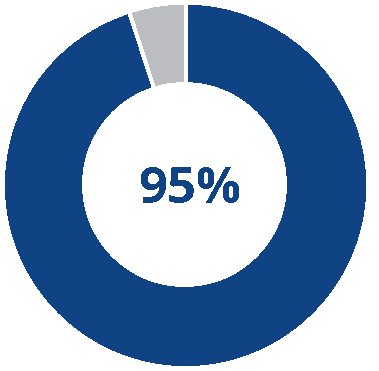

• Annual cash incentive payouts are capped and have challenging performance goals linked to key financial performance metrics • Long-term equity incentives are aligned with long-term stockholder value creation • At-risk compensation based upon performance increased in 2020. Approximately 80% of NEO compensation (excluding the CEO) in 2020 was performance based • Executives exceed stock ownership guidelines, aligning with interests of stockholders | | Say-on-pay approval

during last

stockholder vote in 2020 |

| | | | | | | | |

|

Proposal

2 | Ratify Deloitte & Touche LLP as our Independent

Registered Public Accounting Firm for 2021 The Board recommends a vote FOR this proposal. |

| |

| | |

The Audit Committee has sole authority to appoint and replace the CompensationCompany’s independent registered public accounting firm, which reports directly to the Audit Committee, and is directly responsible for its compensation and oversight of its work. The Audit Committee conducted its annual evaluation of Deloitte & Touche LLP and, after assessing the Nominatingperformance and Corporate Governanceindependence of Deloitte & Touche LLP, the Audit Committee meet without employee directors or management present from timeconcluded that the best course of action was to timereappoint Deloitte & Touche LLP as they deem necessary.our independent external auditor for 2021.

We are asking you to ratify this appointment. If stockholders fail to ratify the appointment, the Audit Committee will consider it a directive to consider other accounting firms for the subsequent year.

Director Meetings and Policy Regarding Board Attendance. It has been the practice of our Board and its committeesFees Paid to hold at least four in-person regular meetings each year. The Board and its committees also have telephone meetings throughout the year. In accordance with our Corporate Governance Guidelines, our directors are expected to prepare for, attend and actively participate in meetings of the Board and its committees. Our directors are expected to spend the time needed at each meeting and to meet as frequently as necessary to properly discharge their responsibilities. We encourage members of our Board to attend annual meetings of stockholders, but we do not have a formal policy requiring them to do so.

Stock Ownership Guidelines.Deloitte & Touche. The Board adopted stock ownership guidelines to more closely align the interestsfees for services provided by Deloitte & Touche LLP, member firm of our directorsDeloitte Touche Tohmatsu, and executive officers with those of our long-term stockholders. Under the guidelines, the following persons are expected to maintain a minimum investment in our common stock as follows: for non-employee directors, the lesser of 3,000 shares or three times their annual cash Board retainer (excluding committee retainers); for the Chief Executive Officer, five times his annual salary; and for senior executive officers, the lesser of 5,000 shares or one times their respective annual salaries. Vested stock optionsaffiliates, to the Company were:

| | | | | | | | |

| Fees |

| Fee Category | 2020 | | 2019 | |

| Audit fees | $ | 2,247,738 | | $ | 2,440,990 | |

| Audit-related fees | — | — |

| Tax fees | 145,000 | 90,000 |

| All other fees | — | — |

| Total Fees | $ | 2,392,738 | | $ | 2,530,990 | |

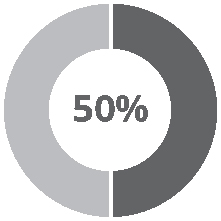

In 2020 and unvested restricted stock units count toward2019, the stock ownership levels. Indirect ownershippercentage of shares through a separate legal entity counts toward fulfillment of the ownership guidelines. These ownership levels aretotal fees paid to be achieved no later than four years after the election as a director or as an executive officer, except that prior to such time the director or officer is expected to retain a certain portion of stock issued upon exercise of stock options or vesting of restricted stock units until the minimum ownership levels are attained. All directorsour independent registered public accounting firm for audit fees were 94% and executive officers were in compliance with our stock ownership guidelines as of December 31, 2017.96%, respectively.

Board Self-Assessments.

9

9

Table of Contents

| | | | | |

| Page |

| 2021 ANNUAL LETTER | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Executive Compensation | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | |

|

| This Proxy Statement contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and we intend that such forward-looking statements be subject to the safe harbors created thereby. For this purpose, any statements contained in this Proxy Statement except for historical information are forward-looking statements. Without limiting the generality of the foregoing, words such as “may,” “will,” “expect,” “believe,” “anticipate,” “intend,” “could,” “estimate,” or “continue” or the negative or other variations thereof or comparable terminology are intended to identify forward-looking statements. The forward-looking statements included herein are based on current expectations of our management based on available information and involve a number of risks and uncertainties, all of which are difficult or impossible to accurately predict and many of which are beyond our control. As such, our actual results may differ significantly from those expressed in any forward-looking statements. Factors that may cause or contribute to such differences include, but are not limited to, those discussed in more detail in the section titled “Risk Factors” and elsewhere in our Annual Report and other filings with the SEC. We undertake no obligation to revise the forward-looking statements contained herein to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. |

|

10 The Board conducts annual self-evaluations and the committees conduct bi-annual self-assessments to determine whether they are functioning effectively. NOTICE OF 2021 ANNUAL MEETING AND PROXY STATEMENT

| | | | | | | | |

|

Proposal

1 | Election of Nine Directors The Board of Directors recommends a vote FOR each director nominee named in this Proxy Statement. |

| |

| | |

The Nominating and Corporate Governance Committee oversees the Board(the "NCGC") is responsible for identifying and committee self-assessments. Each committee also reviews its own performance bi-annually and reports the results to the Board. Each committee reviews and reassesses the adequacy of its charter annually and recommends proposed changes to the Board.

Prohibition on Hedging; Limits on Pledging. Under our insider trading policy, no director or employee may engage in shorting shares of our common stock, or buying or selling puts, calls or derivatives related to our common stock. A director or officer of the Company may not pledge shares constituting more than 20% of his or her total stock ownership. Pledges of shares constituting 20% or less of total stock ownership are subject to certain conditions.

Governance Trends and Director Education. The Board and its committees proactively monitor legislative and regulatory initiatives, as well as other corporate governance trends and their potential impact on the Company. Each director has access to publications and other resources that cover these matters. In addition, we reimburse relevant director education expenses.

The Board receives presentations from professionals with expertise in corporate law, governance and other related topics.These experts have specialized knowledge of regulatory actions, governance trends and various other corporate governance topics. Additionally, our directors participate in continuing education sessions to remain informed on recent trends applicable to their committee duties. Likewise, newly elected directors attend a comprehensive director orientation program that covers, among other things, our strategy, business structure, financial performance, and competitive landscape. New committee members are also provided training on committee policies, practices and trends. As part of this program, directors are invited to participate in a tour of selected facilities of the Company. To further familiarize directors with our expanding operations, we conduct Board meetings at our major facilities from time to time.

The committees actively engage with senior management and other parties when necessary to further assess the current environment or respond to governance related matters. The Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee each routinely receive updates on matters applicable to their responsibilities from legal counsel, auditors and independent consultants.

Code of Business Conduct. We have a code of business conduct that applies to all of our directors and employees, including our Chief Executive Officer, Chief Financial Officer and other executive officers. Our code of business conduct includes provisions covering conflicts of interest, business gifts and entertainment, outside activities, compliance with laws and regulations, insider trading practices, antitrust laws, payments to government personnel, bribes or kickbacks, corporate record keeping and accounting records. The code of business conduct is posted on our website at investor.ipgphotonics.com/corporate-governance/governance-documents.

Proceduresevaluating nominees for Submitting Complaints. We have procedures to treat complaints regarding accounting, internal accounting controls, auditing matters, fight against bribery, banking, and financial crime, including submission of confidential and anonymous concerns regarding questionable accounting, internal accounting controls or auditing matters raised by our directors, officers and employees. These procedures are posted on our website at investor.ipgphotonics.com/corporate-governance/governance-documents.

Board Leadership Structure

As of the date of this proxy statement, the positions of Chairman of the Board and Presiding Independent Director are held by two different individuals. Dr. Gapontsev, our Chief Executive Officer, also serves as the Chairman of the Board. Our independent directors determined several years ago that, for effective board governance, it is important to have a presiding independent director. Mr. Peeler has been selected as the Presiding Independent Director for the term ending June 2018.

Dr. Gapontsev became our Chief Executive Officer and Chairman in 1998. His dual role was created when the Board was first established in 2000. Our directors believe that each of the possible leadership structures for a board has its particular benefits and drawbacks which must be considered in the context of the specific circumstances, culture and challenges facing a company, and that such consideration is the responsibility of a company's board that has a diversity of views and experiences. Our directors come from a variety of organizational backgrounds and have direct experience with a wide range of leadership and management structures. The makeup of our Board puts it in a strong position to evaluate the pros and cons of the various types of board leadership structures and to ultimately decide which form is in the best interests of our stockholders. The independent directors believe that having Dr. Gapontsev serve in both capacities is in the best interest of the Company and its stockholders because it allows Dr. Gapontsev to more effectively execute the Company's strategic initiatives and business plans. He is the founder of the Company and beneficially owns approximately 14% of the Company's common stock. The duality of Dr. Gapontsev's roles as Chairman and Chief Executive Officer creates clear and unambiguous authority, which is essential to effective management. The Board and management can respond more effectively to a distinct line of authority. Further, given that he is closer to the Company's business than any other Board member and he has the benefit of over twenty years of operations and executive management experience within the Company, Dr. Gapontsev is best-positioned to set the Board's agenda and provide leadership. Dr. Gapontsev's extensive scientific and business experience also gives him vast industry knowledge, which the Board believes is critical for the chairman of the board of a company that operates in a highly technical industry. The combined Chairman/Chief Executive structure is a leadership model that has served our stockholders well for many years.

The Board also recognizes the importance of having in place, and building upon, a counterbalancing structure to ensure that it functions in an appropriately independent manner. As a result, the Board enhanced its governance structure several years ago by creating the position of Presiding Independent Director with leadership authority and responsibilities. The duties and responsibilities of the Presiding Independent Director include: setting the agenda for, and leading, executive sessions of the independent directors; providing consolidated feedback from those meetings to the Chairman and Chief Executive Officer; providing input on the agenda for Board meetings; periodically providing feedback on the quality and quantity of information flow from management; having the authority to call meetings of the independent directors; facilitating discussions outside of scheduled Board meetings among the independent directors on key issues as required; serving as a non-exclusive liaison with the Chairman and Chief Executive Officer in consultation with the other independent directors; interviewing Board candidates as appropriate; and leading the determination of the goals and objectives for the Chairman and Chief Executive Officer with the input of the independent directors and the annual performance evaluation for him with the input of the independent directors and providing that evaluation to the Compensation Committee. In the event of a crisis, the Presiding Independent Director would have an increased role in crisis management oversight. The independent directors of our Board elected Mr. Peeler as the Presiding Independent Director for the term ending June 2018, and this position is voted upon annually by our independent directors.

The Board believes that the position and responsibilities of a presiding independent director and the regular use of executive sessions of the independent directors without the Chief Executive Officer or other executive officers present, along with the Company's strong committee system and substantial majority of independent directors, allow the Board to maintain effective oversight.

Risk Oversight

The Board and management recognize that effectively monitoring and managing risk are essential to the successful execution of the Company's strategy. The Board reviews strategy regularly with management and provides input to management. As part of its oversight of operations, the entire Board reviews and discusses the performance of the Company and the principal risks involved in the operations and management of the Company. The Board allocates risk oversight responsibility among the full Board, the independent directors acting as a group and the three standing committees of the Board. The Nominating and Corporate Governance Committee periodically reviews risk oversight matters and responsibilities, then makes recommendations to the Board to allocate risk oversight responsibilities.

The Board as a whole reviews risk management practices and a number of significant risks in the course of its reviews of corporate strategy, management reports and other presentations. The independent directors as a group, the Audit Committee and the Compensation Committee all participate in senior executive succession and resource planning. The standing committees also contribute to succession and resource planning oversight for management. The Audit Committee oversees certain financial risks and recommends guidelines to monitor and control such exposures. The Compensation Committee reviews the Company's executive compensation programs, their effectiveness at both linking executive pay to performance and aligning the interests of our executives and our stockholders, and oversees an entity-wide compensation risk assessment. The Nominating and Corporate Governance Committee reviews significant related person transactions with directors, executives and managers and may conduct negotiations on behalf of the Company in connection with related person transactions and retain independent advisors to assist it. The Board's risk oversight role is independent from the Company's day-to-day management, as more than two-thirds of the current directors are independent and therefore have no conflicts that might discourage critical review of the Company's risks.

Communication with our Board of Directors

Interested parties wishing to writerecommending to the Board a specified directorslate of nominees for election at the Annual Meeting. The NCGC has recommended, and the Board has approved, the following nominees for terms expiring at the annual meeting to be held in 2022, until a successor is elected and qualified or until his or her earlier death, resignation or removal and, unless otherwise marked, a committeeproxy will be voted for such nominees: Dr. Gapontsev, Dr. Scherbakov, Mr. Child, Ms. Desmond, Mr. Dougherty, Mr. Meurice, Ms. Pavlova, Mr. Peeler, and Mr. Seifert. All of the Board should send correspondencedirector nominees set forth in our proxy card have consented to the Office of the Secretary, IPG Photonics Corporation, 50 Old Webster Road, Oxford, Massachusetts 01540. All written communications receivedbeing named in such manner from stockholders ofthis Proxy Statement and to serving if elected. For more information regarding the Company will be forwarded to the members or committee of the Board to whom the communication is directed or, if the communication is not directed to any particular member(s) or committee(s) of the Board, the communication shall be forwarded to all members of the Board.

RELATED PERSON TRANSACTIONS

The Board adopted a related person transaction policy that requires the Company's executive officers, directors, nominees for director, and owners of more than 5% of the Company's shares to promptly notify the Secretary in writing of any transaction in which (i) the amount exceeds $100,000, (ii) the Company is, was or is proposed to be a participant and (iii) such person or such person's immediate family members ("Related Persons") has, had or may have a direct or indirect material interest (a "Related Person Transaction"). Subject to certain exceptions in the policy, Related Person Transactions must be brought to the attention of the Nominating and Corporate Governance Committee for an assessment of whether the transaction or proposed transaction should be permitted. In deciding whether to approve or ratify the Related Person Transaction, the Nominating and Corporate Governance Committee considers relevant facts and circumstances. If the Nominating and Corporate Governance Committee determines that a Related Person has a direct or indirect material interest in any such transaction, the Committee must review and approve, ratify or disapprove the Related Person Transaction.

Pursuant to our Corporate Governance Guidelines, we expect each of our directors to ensure that other existing and future commitments do not conflict with or materially interfere with his or her service as a director. Directors are expected to avoid any action, position or interest that conflicts with our interests or gives the appearance of a conflict. In addition, directors are required to inform the chairman of our Nominating and Corporate Governance Committee prior to joining the Board of another public company to ensure that any potential conflicts, excessive time demands or other issues are carefully considered.

The Nominating and Corporate Governance Committee reviewed and approved the following Related Person Transactions which were conducted on an "arm's length" basis with the Company. Members of the Nominating and Corporate Governance Committee having an interest in a transaction excuse themselves for the consideration and approval of the transaction in which they have an interest.

In 2017, the Company purchased from Veeco Instruments Inc. various equipment, parts and services amounting to approximately $2,296,000. Mr. Peeler, a non-employee member of our Board, is the Chief Executive Officer and Chairman of the Board of Directors of Veeco Instruments Inc. For several years before Mr. Peeler was elected to our Board, Veeco Instruments Inc. was a provider of equipment, parts and services to the Company.

Previously, Dr. Gapontsev leased the annual right to use 25% of the Company's corporate aircraft under an October 2014 lease (the "2014 Lease"), which was superseded by a new lease signed in July 2017 (the "2017 Lease") in connection with the purchase of a different aircraft. The 2017 Lease expires in July 2022. The annual lease rate under the 2017 Lease is $924,700 and future rent payments are adjusted annually based upon the costs of operating the aircraft. The annual lease rate under the 2014 Lease was $651,000. Dr. Gapontsev paid the Company $753,000 in 2017 for use of the aircraft, and in addition directly paid an unrelated flight management firm for the direct and incidental operating costs of his private use including pilot fees, fuel and other costs.

BOARD OF DIRECTORS

Mr. William Hurleysee Director Nominees below. Ms. Catherine P. Lego decided toshe will not stand for re-election toat the Annual Meeting. We extend our Board of Directors at our 2018 annual meeting. IPG Photonics extends its sincere appreciation to Mr. HurleyMs. Lego for the valuable contributions heand guidance she provided to our Company and stockholders during hisher service as a member of our Board since 2006. 2016.

In considering each director nominee and the composition of the Board as a whole, the NCGC evaluates members based on their expertise and diverse perspectives, experiences, qualifications, attributes and skills because the NCGC believes that these attributes enable a director nominee to make significant contributions to the Board, IPG and our stockholders.

The director nominees have a mix of various skills and qualifications, some of which are listed in the table below. These collective attributes enable the Board currently has set the numberto provide insightful leadership as it strives to advance our strategies and deliver returns to stockholders.

| | | | | | | | | | | | | | |

| | | | |

| | Lasers and Technology | | We have sought directors with management and operational experience in the industries in which we compete. For example, in 2019 we added a director with expertise in optical and electronics components, and telecommunications products. As a diversified technology, science-based company, directors with technology backgrounds understand the Company’s technology platforms and the importance of investing in new technologies for future growth. |

| | |

| | Financial Literacy | | Knowledge of finance or financial reporting; experience with debt/capital market transactions and/or mergers and acquisitions strengthen the Board’s oversight of financial reporting and internal controls. Financial metrics are used to measure our performance. All directors must understand finance and financial reporting processes. Two of the Audit Committee members qualify as “audit committee financial experts.” |

| | |

| | Global Business | | Global business experience is critical to the Company’s international operations and growth with 79% of sales from outside the U.S. in 2020. Knowledge of Asian and European business practices are valuable to understanding our business and strategy. |

| | |

| | Manufacturing

and Operating | | As a vertically-integrated company, manufacturing experience and customer service on a global scale are important to understanding the operations and capital needs of the Company. |

| | |

| | Business Development

and M&A | | We have used and will continue to use acquisitions to achieve our strategic goals. Directors with experience in business development and mergers and acquisitions provide valuable perspectives regarding process, due diligence, risk assessment and integration of potential partners. |

| | |

11 NOTICE OF 2021 ANNUAL MEETING AND PROXY STATEMENT

Proposal 1 Election of directors at ten. The numberNine Directors

| | | | | | | | | | | | | | |

| | Risk Management | | In light of the Board’s role in overseeing risk management and understanding the most significant risks facing the Company, including cybersecurity risk, we continue to require directors with experience in risk management and oversight. |

| | |

| | Executive Leadership | | Significant leadership experience, including services as a CEO, senior executive, division president or functional leader within a complex organization enhances the Board’s leadership role. |

| | |

| | Other Public Company Boards | | Directors with current or recent membership on other public company boards provide valuable perspectives in many areas including operations, strategy, governance and compensation. |

| | |

| | Non-Corporate Experience | | Experience from backgrounds beyond the executive suite, including non-corporate backgrounds such as non-profit organizations, government and academia. |

| | |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Gapontsev | Scherbakov | Child | Desmond | Dougherty | Meurice | Pavlova | Peeler | Seifert | |

| | | | | | | | | | | |

| Lasers and Technology | ● | ● | | | ● | ● | | ● | | |

| Financial Literacy | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

| Global Business | ● | ● | ● | ● | ● | ● | | ● | ● | |

| Manufacturing

and Operating | ● | ● | ● | ● | ● | ● | | ● | ● | |

| Business Development

and M&A | ● | ● | ● | ● | ● | ● | | ● | ● | |

| Risk Management | ● | ● | ● | ● | ● | ● | | ● | ● | |

| Executive Leadership | ● | ● | | ● | ● | ● | | ● | ● | |

| Other Public

Company Boards | | | ● | ● | ● | ● | | ● | ● | |

| Non-Corporate Experience | | | | ● | | | ● | | | |

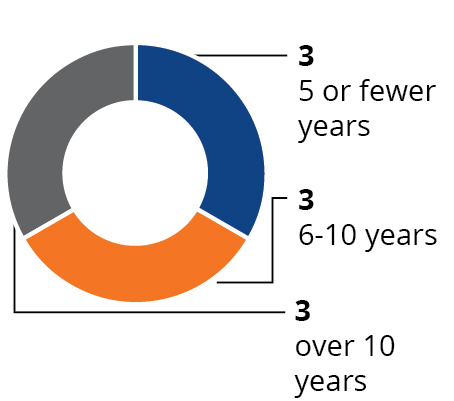

| Years on Board | 23 | 21 | 21 | 0 | 2 | 7 | 0 | 9 | 7 | |

| Age | 82 | 73 | 66 | 54 | 61 | 64 | 42 | 66 | 57 | |

| Gender | M | M | M | F | M | M | F | M | M | |

| Born Outside of U.S.A. | ● | ● | | ● | | ● | ● | | ● | |

| Race/Ethnicity | C | C | C | C | C | C | C | C | C | |

C = Caucasian/White

12 NOTICE OF 2021 ANNUAL MEETING AND PROXY STATEMENT

Proposal 1 Election of directors will be set at nine directors from and after the 2018 annual meeting.Nine Directors

The following table sets forth certain information as of the date of this proxy statementProxy Statement regarding the director nominees. Each of our incumbent directors, other than Mr. Hurley who decided to not stand for re-election, has been nominated by the Board for election at our 2018 annual meeting.

Valentin P. Gapontsev, Ph.D.

Director since 1998

Chief Executive Officer and Chairman of the Board

Age 79

Dr. Gapontsev has been the Chief Executive Officer and Chairman of the Board of IPG since our inception. Prior to founding the company in 1990, Dr. Gapontsev served as senior scientist in laser material physics and head of the laboratory at the Soviet Academy of Science's Institute of Radio Engineering and Electronics in Moscow. In 2006, he was awarded the Ernst & Young® Entrepreneur of the Year Award for Industrial Products and Services in New England, and in 2009, he was awarded the Arthur L. Schawlow Award by the Laser Institute of America. In 2011, he received the Russian Federation National Award in Science and Technology, and he was selected as a Fellow of the Optical Society of America. Dr. Gapontsev holds a Ph.D. in Physics | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | Dr. Gapontsev has been the CEO and Chairman of the Board of IPG since our inception. Prior to founding the Company's predecessor in 1990, Dr. Gapontsev served as senior scientist in laser material physics and head of the laboratory at the Soviet Academy of Science’s Institute of Radio Engineering and Electronics in Moscow. His innovations and inventions are credited with having created the high power fiber laser industry. Dr. Gapontsev is the named inventor on over 100 patents and author of over 200 scientific papers. In 2006, he was awarded the Ernst & Young® Entrepreneur of the Year Award for Industrial Products and Services in New England and in 2009, he was awarded the Arthur L. Schawlow Award by the Laser Institute of America. In 2011, he received the Russian Federation National Award in Science and Technology, and he was selected as a Fellow of the Optical Society of America. Dr. Gapontsev holds a Ph.D. in Laser Materials from the Moscow Institute of Physics and Technology. KEY ATTRIBUTES, EXPERIENCE AND SKILLS Dr. Gapontsev is the founder of the Company and has successfully led the Company and the Board since the Company was formed to now. In the roles of CEO and Chairman of the Board, he has been responsible for formulation and execution of IPG’s strategy and providing leadership and oversight of IPG’s business during a period of rapid and profitable growth, as well as business contractions. He has over thirty years of academic research experience in the fields of solid state laser materials, laser spectroscopy and non-radiative energy transfer between rare earth ions and is the author of numerous scientific publications and several international patents. His strategic foresight and entrepreneurial spirit along with his deep scientific understanding has guided the Company’s continued growth, innovation and technology leadership. |

AGE: 82 DIRECTOR SINCE: 1998 COMMITTEES: None | |

| | | | | | | | | |

| | | | | | | | | |

| | Lasers and Technology | Financial Literacy | Global

Business | Manufacturing

and Operating | Business

Development

and M&A | Risk

Management | Executive

Leadership | |

| | | | | | | | | |

13

13

Proposal 1 Election of Nine Directors

Key Attributes, Experience and Skills

He is the founder of the Company and has successfully led the Company and the Board since the Company was formed. In the roles of Chief Executive Officer and Chairman of the Board, he has been responsible for formulation and execution of IPG's strategy and providing leadership and oversight of IPG's business during a period of rapid and profitable growth, as well as business contractions. He has over thirty years of academic research experience in the fields of solid state laser materials, laser spectroscopy and non-radiative energy transfer between rare earth ions and is the author of many scientific publications and several international patents. His strategic foresight and entrepreneurial spirit along with his deep scientific understanding has guided the Company's continued growth and technology leadership. Under Dr. Gapontsev's leadership, the Company continues to generate strong revenue and earnings growth.

Eugene A. Scherbakov, Ph.D.

Director since 2000

Chief Operating Officer, Managing Director of IPG Laser GmbH and Senior Vice President of Europe and Director

Age 70 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | Dr. Scherbakov has served as Chief Operating Officer since February 2017, Managing Director of IPG Laser GmbH, our German subsidiary, since August 2000 and Senior Vice President-Europe since 2013. He served as the Technical Director of IPG Laser from 1995 to August 2000. From 1983 to 1995, Dr. Scherbakov was a senior scientist in fiber optics and head of the optical communications laboratory at the General Physics Institute, Russian Academy of Science in Moscow. Dr. Scherbakov graduated from the Moscow Physics and Technology Institute with an M.S. in Physics. In addition, Dr. Scherbakov attended the Russian Academy of Science in Moscow, where he received a Ph.D. in Quantum Electronics from its Lebedev Physics Institute and a Dr.Sci. degree in Laser Physics from its General Physics Institute.

Key Attributes, Experience and Skills

Dr. Scherbakov has extensive knowledge of the Company's business as Managing Director of IPG Laser GmbH, which produces a large volume of our products and is the source of many developments in products, technology and applications. The leadership and operational expertise of Dr. Scherbakov have contributed to IPG increasing

KEY ATTRIBUTES, EXPERIENCE AND SKILLS Dr. Scherbakov has extensive knowledge of the Company’s business as Managing Director of IPG Laser GmbH, which produces a large volume of our products and is the source of many developments in products, technology and applications. He applies his knowledge and experience across our many international branches. The leadership and operational expertise of Dr. Scherbakov have contributed to IPG increasing production, lowering manufacturing costs, managing risk and maintaining high margins compared to our industry peers. He also has extensive technological knowledge of fiber lasers, their components and manufacturing processes. His service as an executive officer of the Company provides the Board with a detailed understanding of the Company’s operations, sales and customers. |

AGE: 73 DIRECTOR SINCE: 2000 COMMITTEES: None | |

| | | | | | | | | |

| | | | | | | | | |

| | Lasers and Technology | Financial Literacy | Global

Business | Manufacturing

and Operating | Business

Development

and M&A | Risk

Management | Executive

Leadership | |

| | | | | | | | | |

14NOTICE OF 2021 ANNUAL MEETING AND PROXY STATEMENT

production, lowering manufacturing costs and maintaining high margins compared to our industry peers. He also has extensive technological knowledge of fiber lasers, their components and the manufacturing process. His service as an executive officer of the Company provides the Board with a detailed understanding of the Company's operations, sales and customers.

Igor Samartsev

Director since 2006

Chief Technology Officer

Age 55

Since 2011, Mr. Samartsev has served as our Chief Technology Officer and since 2005, he was the Deputy General ManagerProposal 1 Election of our Russian subsidiary, NTO IRE-Polus. Prior to that time, he served in technical leadership roles at NTO IRE-Polus. Mr. Samartsev holds an M.S. in Physics from the Moscow Institute of Physics and Technology.Nine Directors

Key Attributes, Experience and Skills

Mr. Samartsev is one of the founders of the Company and has a significant management role in the Company as Chief Technology Officer. As one of the key developers of the technology platform of the Company and leader in the development of many new optical technologies and products that form part of the Company's strategic plan, the Board values Mr. Samartsev's understanding of technology developments at our company.

Michael C. Child

Director since 2000

Independent Director

Age 63

Nominating and Corporate Governance Committee

Directorship at Other Public Company: Finisar Corporation

Since July 1982, Mr. Child has been employed by TA Associates, Inc., a private equity investment firm, where he currently serves as Senior Advisor and, prior to January 2011, he was Managing Director. Mr. Child holds a B.S. in Electrical Engineering from the University of California at Davis and an M.B.A. from the Stanford University Graduate School of Business.From September 2011 until December 2015, Mr. Child was a Lecturer at the Stanford University Graduate School of Business.

Key Attributes, Experience and Skills | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | Since July 1982, Mr. Child has been employed by TA Associates, Inc., a private equity investment firm, where he currently serves as Senior Advisor and, prior to January 2011, he was Managing Director. Mr. Child served previously on the boards of Finisar Corporation, a developer and manufacturer of optical subsystems and components for networks, Eagle Test Systems, Inc., a manufacturer of semiconductor test equipment, and Ultratech Inc., a developer and manufacturer of advanced packaging lithography systems and laser processing technologies. Mr. Child holds a B.S. in Electrical Engineering from the University of California at Davis and an M.B.A. from the Stanford University Graduate School of Business. From September 2011 until December 2015, Mr. Child was a Lecturer at the Stanford University Graduate School of Business. KEY ATTRIBUTES, EXPERIENCE AND SKILLS Mr. Child is an established and experienced investor, including in technology companies, from his three decades of experience at TA Associates, Inc., a private equity investment firm. Over the course of his career, he has overseen numerous investments and sales of portfolio companies, and served on the boards of many public and private companies. Through his experiences, he has gained valuable knowledge in the management, operations and finance of technology growth companies. |

AGE: 66 DIRECTOR SINCE: 2000 COMMITTEES: NCGC | |

| | | | | | | | |

| | | | | | | | |

| Financial Literacy | Global

Business | Manufacturing

and Operating | Business

Development

and M&A | Risk

Management | Other Public

Company

Boards | | |

| | | | | | | | | |

15

15

Proposal 1 Election of Nine Directors

Jeanmarie F. Desmond

Independent Director

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | From April 2019 to February 2020, Ms. Desmond was the Executive Vice President and Chief Financial Officer of DuPont de Nemours, Inc., a global multi-industry specialty solutions company (“DuPont”). Ms. Desmond previously served as Vice President and Co-Controller for DuPont from August 2017 to April 2019, and as finance leader for the Specialty Products division following the merger of DuPont with Dow Chemical. Ms. Desmond served in various leadership roles within DuPont in her 30-year career with the company. She also serves on the board and is treasurer of Delaware Prosperity Partnership, a public-private partnership overseeing economic development in Delaware. Since 2020, she has served on the board of Trinseo S.A., a materials solutions provider and a manufacturer of plastics, latex binders and synthetic rubber. Ms. Desmond earned a B.S. in Accounting from Mt. St. Mary’s University and is a certified public accountant (inactive). KEY ATTRIBUTES, EXPERIENCE AND SKILLS Ms. Desmond brings to the Board substantial finance and accounting experience and extensive experience in technology-driven companies. Her long management experience in a number of key strategic areas including finance leadership and operations financial planning and analysis, tax, internal audit, accounting controls, risk management, mergers and acquisitions, investor relations and public-private partnership brings depth to the skillsets of the Board. |

AGE: 54 DIRECTOR SINCE: 2021 COMMITTEES: Audit Committee DIRECTORSHIP AT OTHER PUBLIC COMPANY: Trinseo S.A. | |

| | | | | | | | |

| | | | | | | | |

| Financial Literacy | Global

Business | Manufacturing

and Operating | Business

Development

and M&A | Risk

Management | Executive

Leadership | Other Public

Company

Boards | Non-Corporate Experience |

| | | | | | | | | |

16 NOTICE OF 2021 ANNUAL MEETING AND PROXY STATEMENT

Proposal 1 Election of Nine Directors

Gregory P. Dougherty

Independent Director

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | Mr. Dougherty served as Chief Executive Officer of Oclaro, Inc., a maker of optical components and modules for the long-haul, metro and data center markets, from June 2013 and has served as a director of Oclaro from April 2009, until its December 2018 acquisition. Prior to Oclaro, Mr. Dougherty served as a director of Avanex Corporation, a leading global provider of intelligent photonic solutions, from April 2005 to April 2009. Mr. Dougherty also served as a director of Picarro, Inc., a manufacturer of ultra-sensitive gas spectroscopy equipment using laser-based technology, from October 2002 to August 2013, and as its Interim Chief Executive Officer from January 2003 to April 2004. From February 2001 until September 2002, Mr. Dougherty was the Chief Operating Officer at JDS Uniphase Corporation (“JDS”), an optical technology company. Prior to JDS he was the Chief Operating Officer of SDL, Inc., a maker of laser diodes, from March 1997 to February 2001 when they were acquired by JDS. Mr. Dougherty serves on the boards of directors of Infinera Corporation, a provider of optical transport networking equipment, software and services to telecommunications service providers and others, since January 2019, Fabrinet, a provider of advanced optical packaging and precision optical, electro-mechanical, and electronic manufacturing services to OEMs of complex products, since February 2019, and MaxLinear, Inc., a provider of radio frequency (RF), analog and mixed-signal integrated circuits, since March 2020. Mr. Dougherty earned a B.S. in optics from the University of Rochester. KEY ATTRIBUTES, EXPERIENCE AND SKILLS Mr. Dougherty contributes to the Board significant leadership, operations, sales, marketing and general management experience in optics and components for telecommunications and other applications. For over three decades, Mr. Dougherty has worked in the optical and components industry and can provide the Board with insight into the industry and conditions in which the Company operates. Having been recently a CEO at a publicly-held company and now serving as a member of the board of several optical and electronics companies, he is familiar with a large range of management, corporate and board responsibilities and brings valuable perspectives to the Board as an independent director. |

AGE: 61 DIRECTOR SINCE: 2019 COMMITTEES: Audit Committee, Compensation Committee (Chair) DIRECTORSHIP AT OTHER PUBLIC COMPANY: Infinera Corporation, Fabrinet and MaxLinear, Inc. | |

| | | | | | | | |

| | | | | | | | |

| | Lasers and Technology | Financial Literacy | Global

Business | Manufacturing

and Operating | Business

Development

and M&A | Risk

Management | Executive

Leadership | Other Public

Company

Boards |

| | | | | | | | | |

17

17

Proposal 1 Election of Nine Directors

Eric Meurice

Independent Director

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | Mr. Meurice was President and Chief Executive Officer of ASML Holding NV, a provider of semiconductor manufacturing equipment and technology, from October 2004 to June 2013, and Chairman until March 2014. From 2001 to 2004, he was Executive Vice President of the Thomson Television Division of Thomson, SA, an electronics manufacturer. From 1995 to 2001, he served as head of Dell Computer’s Western, Eastern Europe and EMEA emerging market businesses. Before 1995, he gained significant technology experience at ITT Semiconductors and at Intel Corporation. Mr. Meurice serves on the boards of Umicore S.A., a recycling and materials company, since April 2015, Soitec S.A., a semiconductor materials manufacturer, since July 2018, and where he was appointed Chairman since March 2019, and Global Blue Group Holding AG, a leader in currency and value added tax processing, since September 2020. He previously served on the boards of Verigy Ltd., a manufacturer of semiconductor test equipment, ARM Holdings plc, a semiconductor intellectual property supplier, NXP Semiconductors N.V., a semiconductor company, and Meyer Burger Technology AG, a solar equipment vendor. Mr. Meurice earned a Master’s degree in Mechanics and Energy Generation at the Ecole Centrale de Paris, a Master’s degree in Economics from la Sorbonne University, Paris, and an M.B.A. from the Stanford University Graduate School of Business. KEY ATTRIBUTES, EXPERIENCE AND SKILLS Mr. Meurice has extensive skills and experience as a manager of several rapidly-growing, complex and global businesses in the capital equipment and electronics fields with several billions of dollars in revenues, most recently as former President and Chief Executive Officer of ASML Holding NV. He has experience managing a publicly-held company as well as experience on serving on several public company boards in the equipment and technology fields such as Soitec S.A., NXP Semiconductors N.V., Umicore S.A., Verigy Ltd. and ARM Holdings plc. Mr. Meurice also has a record of proven leadership as a strategic thinker, operator and marketer at the businesses he managed. |

AGE: 64 DIRECTOR SINCE: 2014 COMMITTEES: NCGC (Chair), Compensation Committee DIRECTORSHIP AT OTHER PUBLIC COMPANY: Umicore S.A., Soitec S.A. and Global Blue Group Holding AG | |

| | | | | | | | |

| | | | | | | | |

| Lasers and Technology | Financial Literacy | Global

Business | Manufacturing

and Operating | Business

Development

and M&A | Risk

Management | Executive

Leadership | Other Public

Company

Boards |

| | | | | | | | |

18 NOTICE OF 2021 ANNUAL MEETING AND PROXY STATEMENT

Proposal 1 Election of Nine Directors

Natalia Pavlova

Director

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | Ms. Pavlova has worked in a variety of roles at non-profit art institutions including the RISD Museum, Worcester Historical Museum and The Willard House and Clock Museum. She also served in sales and marketing roles at the Company previously. Ms. Pavlova holds a Qualification for Fine Art Critic and Historian of Art and Culture from the Russian State University for the Humanities, and an M.S. in Arts Administration from Boston University. She is the wife of co-founder and Chief Technology Officer, Igor Samartsev, and the former daughter-in-law of founder and CEO, Valentin P. Gapontsev. KEY ATTRIBUTES, EXPERIENCE AND SKILLS As a significant stockholder with family association to founders of the Company as well as having served as an employee of the Company in sales and marketing, Ms. Pavlova’s membership on the Board provides it with further engagement by individuals having a long-term perspective and strong economic ties with the Company. Among her specific attributes that qualify her to serve as a member of the Board, Ms. Pavlova possesses extensive knowledge of our history and culture. Ms. Pavlova strengthens the connection between the Company’s founding members and our Board, thereby assisting in the alignment of the Board with the interests of all IPG stockholders. Her experience working for nonprofit organizations adds different perspectives to the boardroom. |

AGE: 42 DIRECTOR SINCE: 2021 COMMITTEES: None | |

| | | | | | | | |

| | | | | | | | |

| | Financial Literacy | Non-Corporate Experience | | | | | | |

| | | | | | | | | |

19

19

Proposal 1 Election of Nine Directors

John R. Peeler

Lead Independent Director

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | Mr. Peeler was Chief Executive Officer of Veeco Instruments Inc. (“Veeco”) from July 2007 until September 2018, and Chairman or Executive Chairman of its board of directors from May 2012 until May 2020. Veeco is a developer and manufacturer of MOCVD, molecular beam epitaxy, ion beam and other advanced semiconductor processes equipment. He was Executive Vice President of JDS and President of the Communications Test & Measurement Group of JDS, which he joined upon the closing of JDS’s merger with Acterna, Inc. in August 2005. Before joining JDS, Mr. Peeler served as President and Chief Executive Officer of Acterna. He has a B.S. and M.E. in Electrical Engineering from the University of Virginia. KEY ATTRIBUTES, EXPERIENCE AND SKILLS Over the course of his career, Mr. Peeler has managed several high-growth technology companies. In addition, he has developed managerial leadership skills through his former position as Chief Executive Officer of Veeco, a publicly-traded company with substantial international operations. His managerial positions have provided him with in-depth knowledge of the service needs of customers in demanding markets, including semiconductor capital equipment, various manufacturing models, research and development, marketing and sales. In these roles, he has also been responsible for attracting and incentivizing executives on his team. These experiences have provided him important insights in support of his positions as Lead Independent Director and a member of the Compensation Committee and the NCGC. |

AGE: 66 DIRECTOR SINCE: 2012 COMMITTEES: Compensation

Committee,

NCGC

| |

| | | | | | | | |

| | | | | | | | |

| | Lasers and Technology | Financial Literacy | Global

Business | Manufacturing

and Operating | Business

Development

and M&A | Risk

Management | Executive

Leadership | Other Public

Company

Boards |

| | | | | | | | | |

20 NOTICE OF 2021 ANNUAL MEETING AND PROXY STATEMENT

Proposal 1 Election of Nine Directors

Thomas J. Seifert

Independent Director

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | Mr. Seifert is Chief Financial Officer of Cloudflare, Inc., an internet performance and security provider, from June 2017 to the present. Since July 2020, he is a member of the board of First Derivatives plc, a publicly held company in Ireland, that is a global technology provider working with some of the world's largest finance, technology, automotive, manufacturing and energy institutions. Mr. Seifert was a member of the board of CompuGroup Medical SE, a publicly held company in Germany, which provides software to support medical and organization activities in medical offices and facilities, from February 2018 to June 2020. Mr. Seifert was the Executive Vice President and Chief Financial Officer of Symantec Corporation, a provider of security, backup and availability solutions, from March 2014 to December 2016. Mr. Seifert served as Executive Vice President and Chief Financial Officer of Brightstar Corporation, a wireless distribution and services company, from December 2012 to March 2014. He was Senior Vice President and Chief Financial Officer at Advanced Micro Devices Inc., a semiconductor company, from October 2009 to August 2012, and served as Interim Chief Executive Officer from January 2011 to September 2012. From October 2008 to August 2009, Mr. Seifert served as Chief Operating Officer and Chief Financial Officer of Qimonda AG, a German memory chip manufacturer, and as Chief Operating Officer from June 2004 to October 2008. He also held executive positions at Infineon AG, White Oak Semiconductor, including the position as Chief Executive Officer, and Altis Semiconductor. Mr. Seifert has a Bachelor’s degree and a Master’s degree in Business Administration from Friedrich Alexander University and a Master’s degree in Mathematics and Economics from Wayne State University. KEY ATTRIBUTES, EXPERIENCE AND SKILLS Mr. Seifert has extensive experience as both an operating executive and chief financial officer of large publicly-held international technology businesses, such as Symantec and Advanced Micro Devices. In these and other senior positions, he developed deep financial and accounting knowledge, as well as managerial leadership skills, in larger organizations. With his background in accounting, finance and management, Mr. Seifert brings broad skills and knowledge to the Board, the Audit Committee and the NCGC including internal controls, mergers and acquisitions, integrations and information technology security. |

AGE: 57 DIRECTOR SINCE: 2014 COMMITTEES: Audit Committee

(Chair) - Audit

Committee Financial

Expert, NCGC DIRECTORSHIP AT OTHER PUBLIC COMPANY: First Derivatives plc | |

| | | | | | | | |

| | | | | | | | |

| Financial Literacy | Global

Business | Manufacturing

and Operating | Business

Development

and M&A | Risk

Management | Executive

Leadership | Other Public

Company

Boards | |

| | | | | | | | | |

| | |

|